Events

- This event has passed.

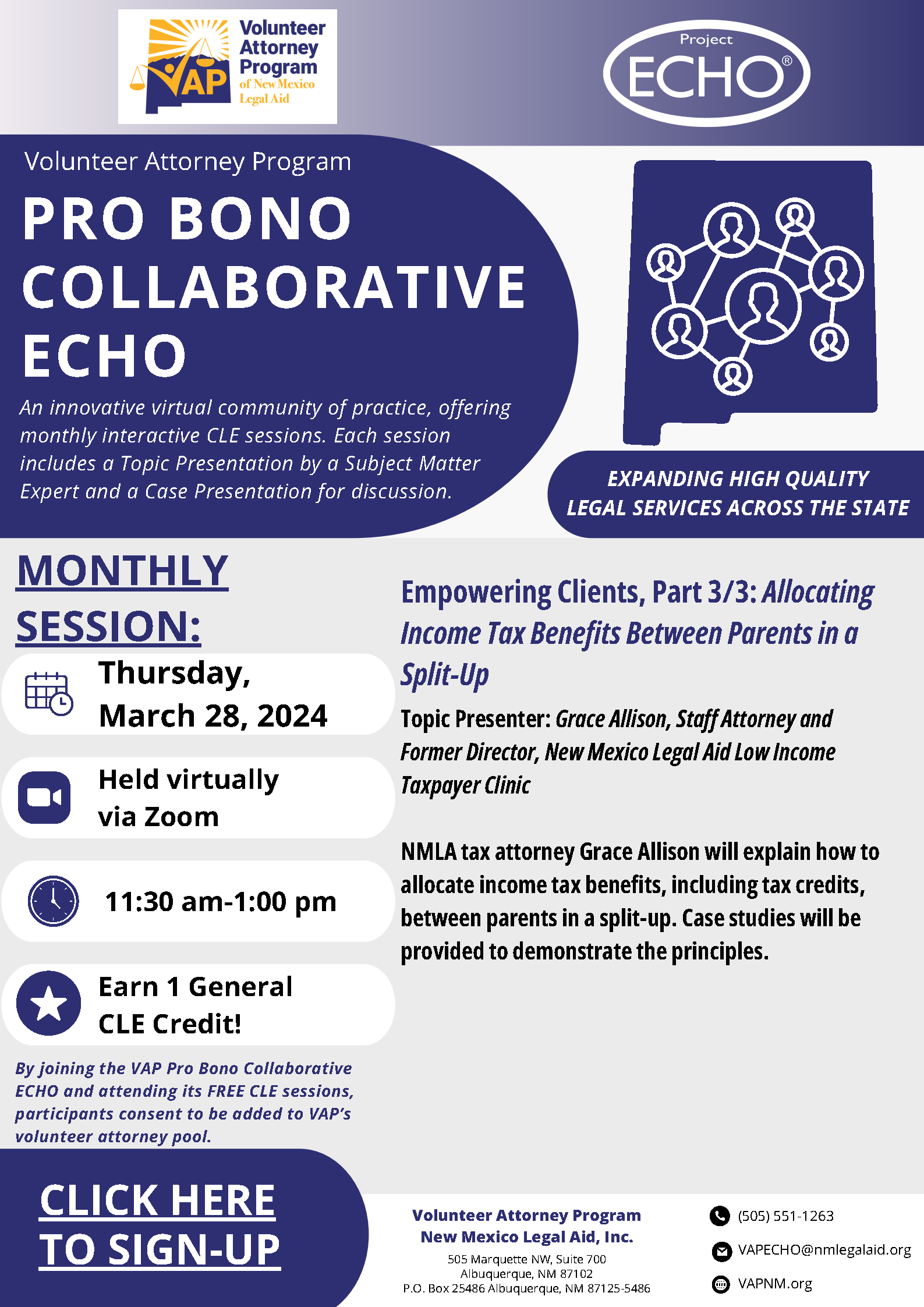

VAP Pro Bono Collaborative ECHO Sessions – Empowering Families/Clients: An Income Tax Perspective, Part 3: Allocating Income Tax Benefits Between Parents in a Split-Up

March 28 @ 11:30 am - 1:00 pm

Empowering Families/Clients: An Income Tax Perspective (1 General CLE Credit per Session)

Presented by: Grace Allison, Staff Attorney and Former Director, New Mexico Legal Aid Low Income Taxpayer Clinic

Prior to joining NMLA, she served for six years as Adjunct Clinical Professor of Law and Qualified Tax Expert in the Low-Income Taxpayer Clinic at the UNM School of Law. A graduate of The University of Chicago Law School and Wellesley College, Grace has practiced as a tax attorney for more than 44 years, “retiring” in 2011 as Tax Counsel, Tax Strategist and Senior Vice President at the Fortune 500 wealth manager, Northern Trust. She has published numerous articles on tax topics in professional journals over the years, and has served on the boards of four New Mexico nonprofits. She is a past Chair of the Charitable Planning and Organizations Group, Real Property Trust and Estate Section of the American Bar Association and is Treasurer of the Tax Section of the State Bar of New Mexico.

3-part series held from 11:30 AM to 1:00 PM

- Thursday, January 25, 2024 – Part 1: Helping Low- & Middle-Income Families Get Their Money From the IRS

- NMLA tax attorney Grace Allison will provide an overview of income tax benefits available to low- and middle-income families from the IRS and the State of New Mexico, and how families can apply for these benefits to boost their available resources. Examples will be provided.

- Thursday, February 22, 2024 – Part 2: Understanding Income Tax Benefits for Low- & Middle-Income Families

- NMLA tax attorney Grace Allison will take a deep dive into income tax benefits, including tax credits, available to low- and middle-income families in New Mexico to boost their available resources, explaining how to determine eligibility. Examples will be provided.

- Thursday, March 28, 2024 – Part 3: Allocating Income Tax Benefits Between Parents in a Split-Up

- NMLA tax attorney Grace Allison will explain how to allocate income tax benefits, including tax credits, between parents in a split-up. Case studies will be provided to demonstrate the principles.

Click here to Join the Pro Bono Collaborative ECHO and attend upcoming sessions.